TL;DR

- Chrome’s desktop dominance reaches new heights at 74%, making Chrome optimisation more critical than ever for reaching the majority of desktop users

- Mobile and desktop usage are converging, with mobile at 50% and desktop surging to 47%. This is a significant shift requiring balanced optimisation strategies for both platforms

- WordPress continues to lead the CMS market globally and in Australia, though Australian businesses show stronger adoption of Squarespace and Wix alternatives

- Shopify remains the leading eCommerce platform, but Squarespace “Add To Cart” shows dramatically stronger performance in Australia, capturing 20% of the market

Leveraging Data for Strategic Digital Growth

Can you believe that’s another year down? Goodbye 2025! Staying informed about internet usage trends is essential for reaching your audience and driving measurable growth. At Clickify, we’re passionate about using data to help our clients succeed online. We’ve analysed the latest statistics to bring you key usage trends shaping digital strategies this year.

Pro Tip: With Chrome extending its dominance to 74% on desktop, optimising your site for Chrome performance is critical. However, don’t overlook Safari’s strong presence on mobile and tablets: testing across browsers ensures everyone gets the best experience.

Browser Market Share Worldwide 2025

Desktop Browser Market Share

StatCounter data from November 2024 to November 2025 shows Chrome’s unprecedented surge in desktop dominance, climbing from 67% to an impressive 74% market share. This represents one of the most significant shifts in recent years. Edge has grown modestly to around 11%, while Safari remains steady at approximately 8%. Firefox continues its gradual decline, now holding just 3% of the market, with Opera and other browsers accounting for less than 3% combined.

Chrome’s strengthening grip on the desktop browser market signals a consolidation around a single platform, making cross-browser testing less critical but Chrome optimisation absolutely essential for reaching the vast majority of desktop users.

Mobile Browser Market Share

The worldwide mobile browser landscape from November 2024 to November 2025 reveals Chrome maintaining its dominant position at approximately 67%. Safari follows at around 21%, while Samsung Internet holds steady near 3%. The remaining market share is distributed among Opera, UC Browser, Firefox, Android, Edge, and QQ Browser, each with less than 2%.

The data shows Chrome’s commanding lead on mobile devices continues to grow, with Safari maintaining its strong position primarily through iOS device usage. The fragmentation among smaller browsers highlights the two-browser dominance in mobile browsing.

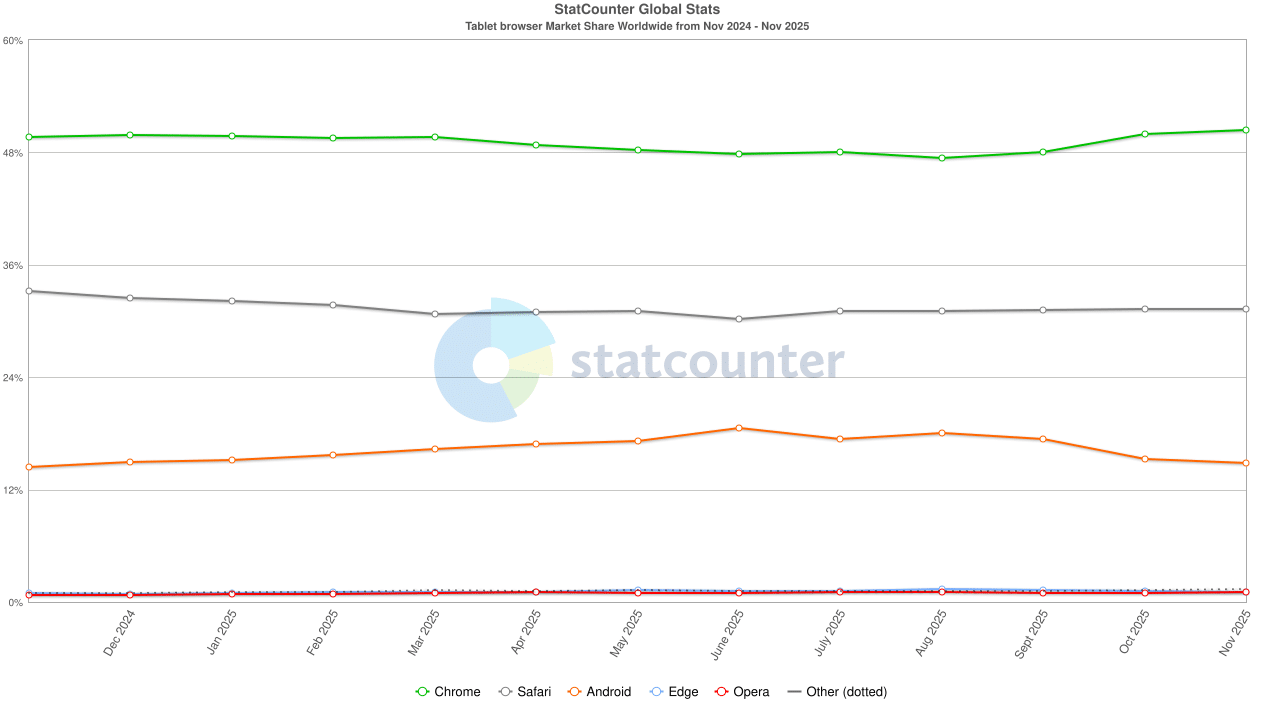

Tablet Browser Market Share

Chrome leads the worldwide tablet browser market from November 2024 to November 2025 with approximately 50% share. Safari follows at roughly 31%, while Android Browser maintains about 14%. Edge, Opera, and other browsers collectively account for less than 5% of the market.

The tablet browser statistics demonstrate a more balanced competition between Chrome and Safari compared to other device categories, reflecting the split between Android and iOS tablet users and their respective default browsers.

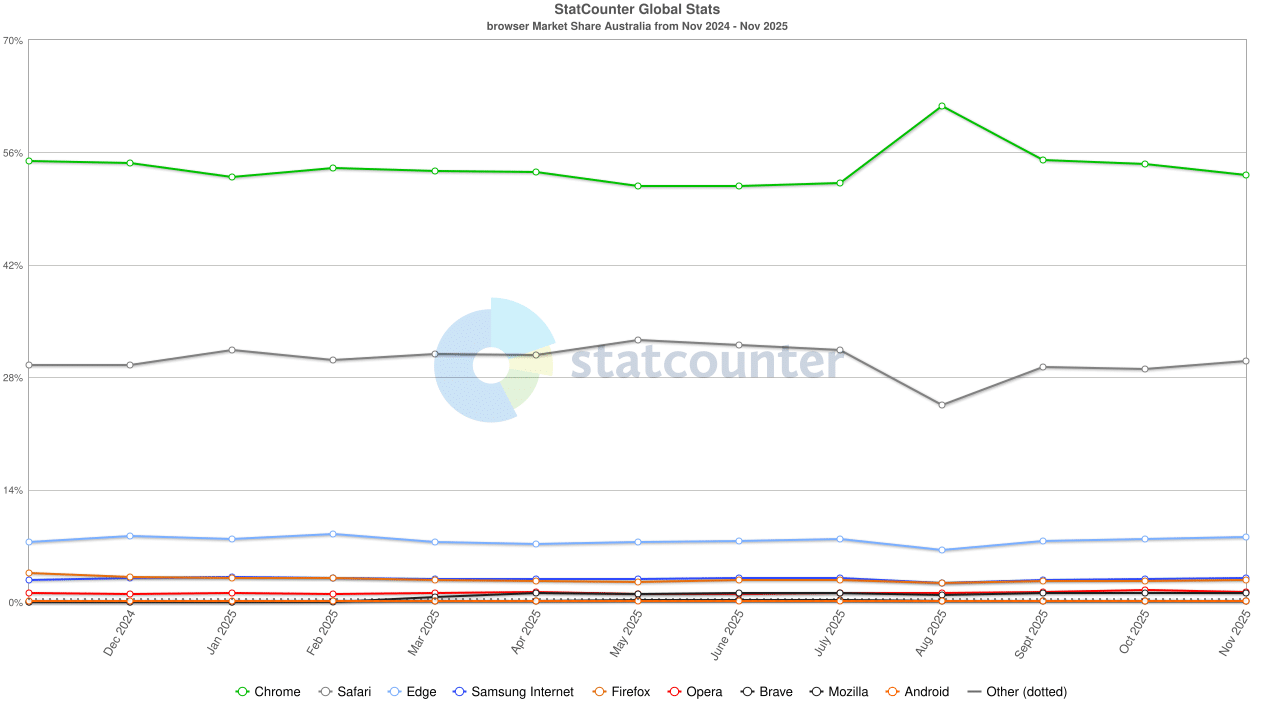

Browser Market Share Australia

Australia’s browser market share from November 2024 to November 2025 shows Chrome holding steady at around 52%, with Safari at approximately 30%. Edge maintains about 8% share, while Samsung Internet, Firefox, Opera, Brave, and Mozilla collectively account for the remaining 10%.

Australian users demonstrate a clear preference for Chrome and Safari, though Edge shows slightly stronger adoption compared to global averages. The data suggests Australian browsing patterns align closely with worldwide trends, with Chrome maintaining market leadership.

Device Market Share in 2025

A significant shift is emerging in worldwide device market share from November 2024 to November 2025. Mobile devices now account for approximately 50% of internet usage, while desktop has surged to nearly 47%. Tablet usage remains minimal at about 3%.

This near-parity between mobile and desktop represents a notable change from previous years, suggesting users are returning to desktop devices for certain tasks. The desktop resurgence may reflect increased remote work, the complexity of certain online tasks, or user preference for larger screens when engaging with content-rich websites.

SIDEBAR! Evolving demographics for Desktop users in 2025:

- Work from Home: The sustained hybrid work model has kept desktop usage higher than pre-pandemic levels

- Content Creators: Desktop remains the preferred platform for content creation, video editing, and professional work

- eCommerce: Desktop users still convert at higher rates, with average order values typically 20-30% higher than mobile

Social Media Stats Worldwide 2025

Facebook remains the leading social network globally with over 3.07 billion active users. Five platforms have now surpassed the 2 billion user mark: Facebook, WhatsApp, YouTube, Instagram, and TikTok. Eight platforms boast over 1 billion active users, demonstrating the continued expansion of social media reach.

This ranking showcases both the staying power of established giants like Facebook and YouTube, alongside the remarkable growth of TikTok, which has crossed the 2 billion user threshold. The presence of both Western and Chinese platforms reflects the truly global nature of social media in 2025.

- Facebook: 3,070 million active users

- WhatsApp: 3,000 million active users

- YouTube: 2,540 million active users

- Instagram: 2,000 million active users

- TikTok: 1,940 million active users

- WeChat: 1,400 million active users

- Telegram: 1,000 million active users

- Messenger: 952 million active users

- Snapchat: 900 million active users

- Douyin: 750 million active users

- Kuaishou: 712 million active users

- Reddit: 695 million active users

- Weibo: 591 million active users

- Pinterest: 570 million active users

- X (Twitter): 561 million active users

CMS Usage Distribution 2025

Content Management System usage data for 2025 reveals WordPress’s continued dominance, powering 38% of the top 1 million sites worldwide and an impressive 44% in Australia. The Australian market shows notable diversity, with Squarespace commanding 12% and Wix holding 13% market share, significantly higher than their global shares of 6% and 11% respectively.

This data indicates that while WordPress maintains its leadership position globally, Australian businesses demonstrate a stronger preference for user-friendly, template-based platforms like Squarespace and Wix compared to the worldwide average.

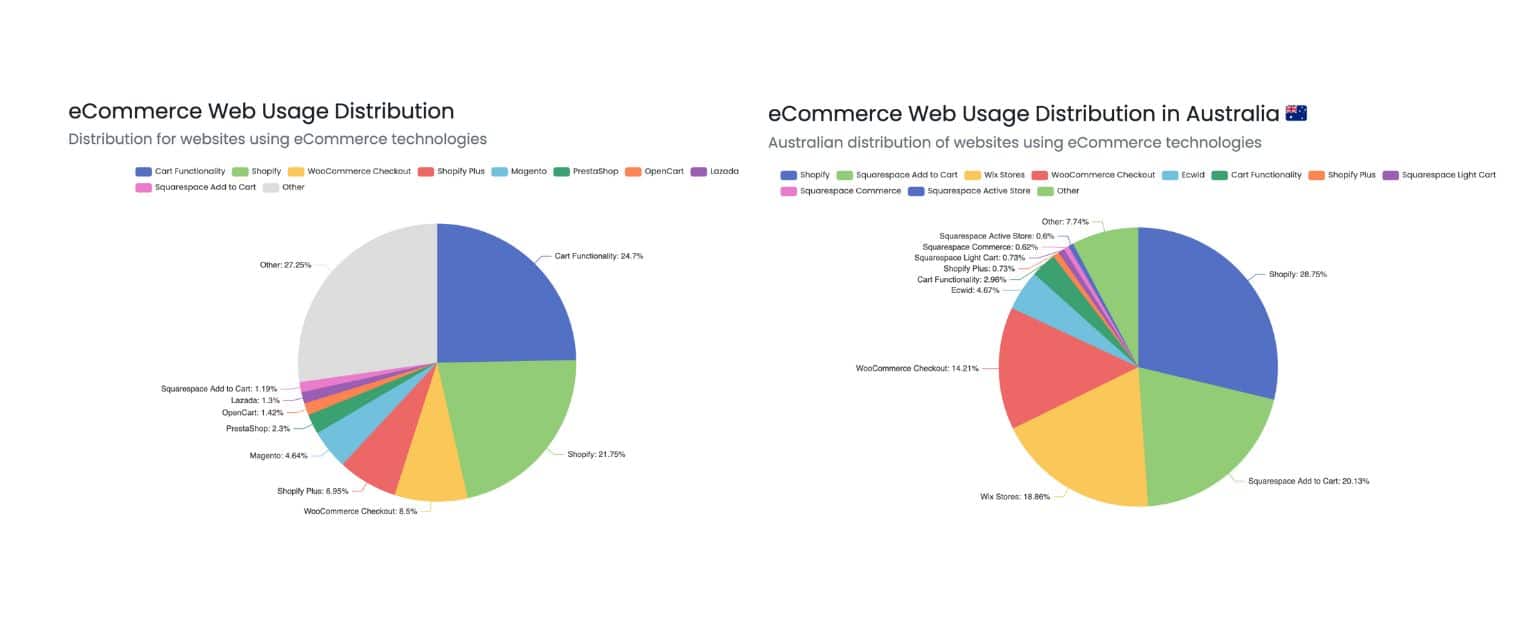

eCommerce Platform Usage 2025

The eCommerce platform landscape in 2025 shows Shopify maintaining its leadership with 28% market share in Australia and 24% globally. However, Australian eCommerce sites display distinct preferences, with Squarespace “Add To Cart” capturing 20% of the Australian market compared to just 4% worldwide. WooCommerce holds 14% globally and 14% in Australia, while Cart Functionality shows stronger adoption in Australia at 3% versus 2% globally.

These statistics highlight regional variations in eCommerce platform selection, with Australian businesses showing a marked preference for Squarespace’s eCommerce solution, likely driven by its design-forward approach and ease of use for small to medium-sized businesses.

Transforming Data into Digital Growth

At Clickify, data is our oxygen. These numbers aren’t just statistics – they’re the roadmap to reaching your customers where they actually are. The near-parity between mobile and desktop usage in 2025 means your digital strategy needs to deliver exceptional experiences on both platforms, not just prioritise one over the other.

Whether you’re looking to optimise your website for Chrome’s growing dominance, expand your social media presence on platforms like TikTok that have crossed the 2 billion user mark, or choose the right eCommerce platform for the Australian market, we’re here to translate these trends into actionable strategies that drive real results.

Our business is getting your business found online.