Harnessing Data for Your Digital Success

As we wrap 2024, understanding the latest trends about how people use the internet is essential for reaching your audience and driving measurable growth in 2025. At Clickify, we’re (delightfully) overzealous about using data to help our clients succeed online. We’ve compiled some key usage trends that shaped digital strategies this year.

Pro Tip: With Chrome still dominating across devices, ensuring your site is optimised for Chrome is a must. However, don’t neglect the nearly 20% on Safari, especially if targeting mobile users.

Browser Market Share Worldwide 2024

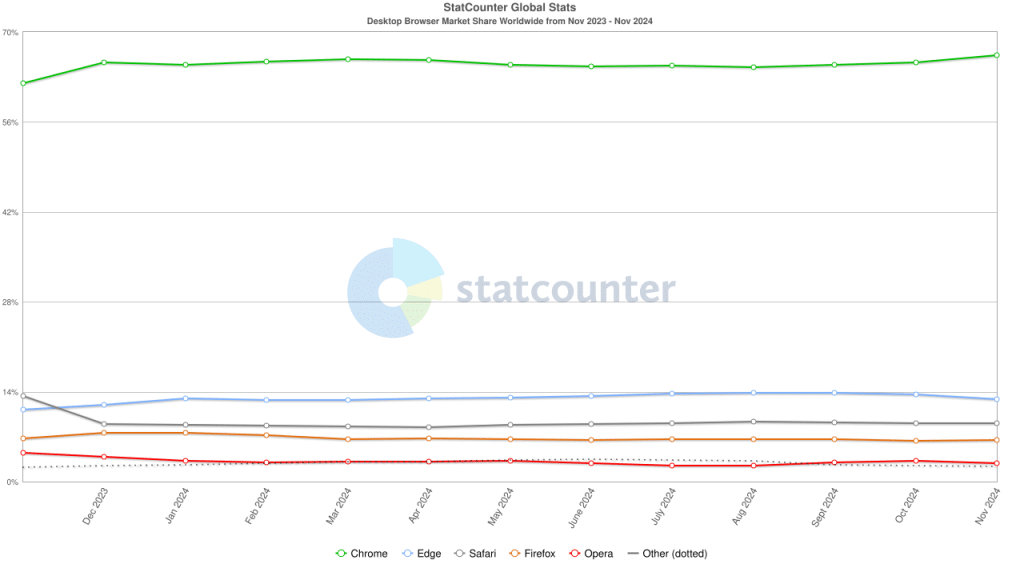

Desktop Browser Market Share

StatCounter data reveals Chrome’s continued global dominance in the desktop browser market, consistently holding over 65% share from November 2023 to November 2024. Edge and Safari compete for a distant second, both around 10%, while Firefox maintains a steady 7-8% share. Opera and other browsers combined account for less than 4%.

The lack of significant shifts in market share over the 12 months suggests that Chrome’s popularity remains unchallenged, with users showing little inclination to switch to alternative desktop browsers.

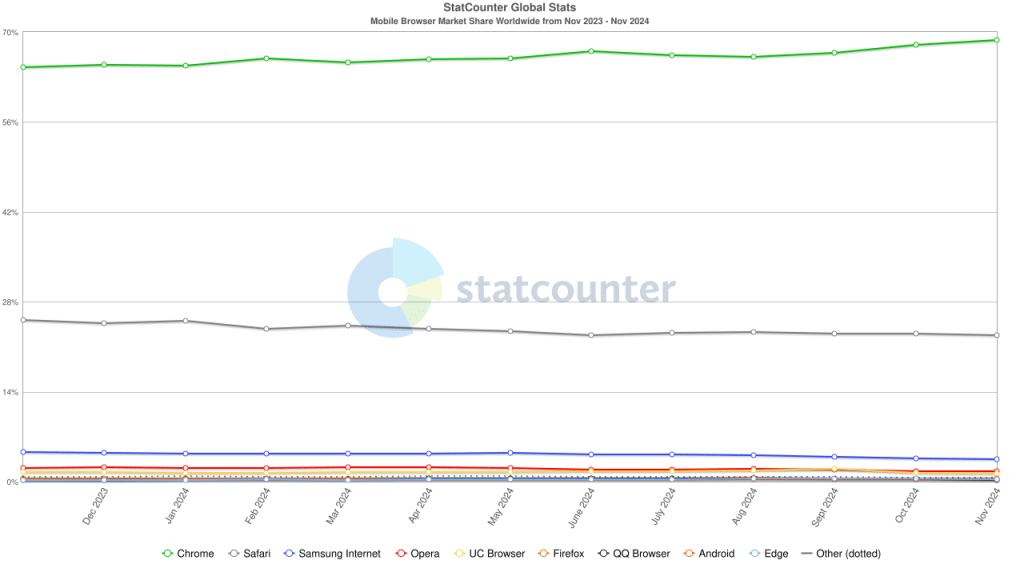

Mobile Browser Market Share

StatCounter data for worldwide mobile browser usage from November 2023 to November 2024 shows Chrome maintaining a substantial lead at around 62%. Safari follows at approximately 24%, while Samsung Internet holds steady near 5%. The remaining market share is divided among several smaller players, including Opera, UC Browser, Firefox, QQ Browser, Android, and Edge.

The data suggests that Chrome and Safari dominate the mobile browser landscape, with users heavily favouring these two options over alternatives.

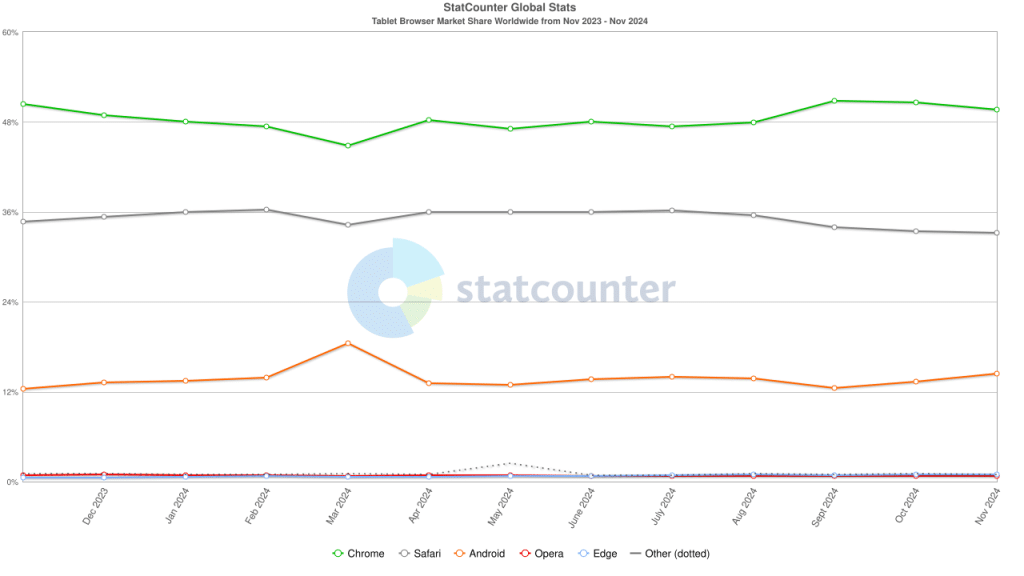

Tablet Browser Market Share

Chrome dominated the worldwide tablet browser market from November 2023 to November 2024, holding a steady share of around 47%. Safari follows at approximately 37%, while Android Browser trails at about 12%. The remaining market is divided among Opera, Edge, and other smaller players.

The data indicates that Chrome and Safari are the clear leaders in the tablet browser space, with Android Browser being the only other significant competitor, albeit with a considerably smaller share.

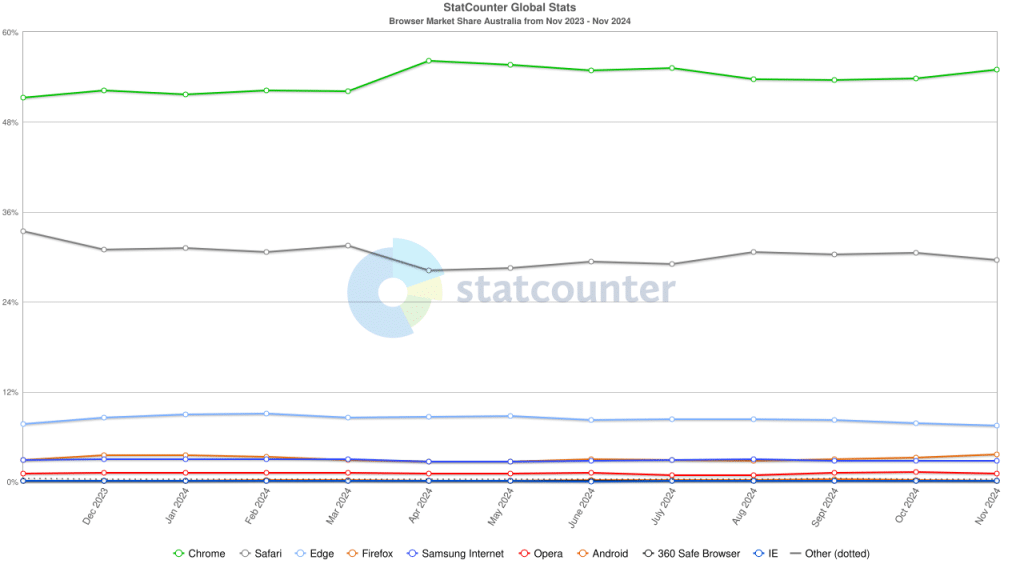

Browser Market Share Australia

Australia’s browser market share from November 2023 to November 2024 reveals Chrome’s significant lead at around 53%, followed by Safari at approximately 31%. Edge and Firefox maintain shares of about 5% and 3%, respectively. Samsung Internet, Opera, Android, 360 Safe Browser, and IE each hold less than 2% of the market.

The statistics suggest that Australian users heavily prefer Chrome and Safari, with other browsers collectively accounting for a small portion of the market.

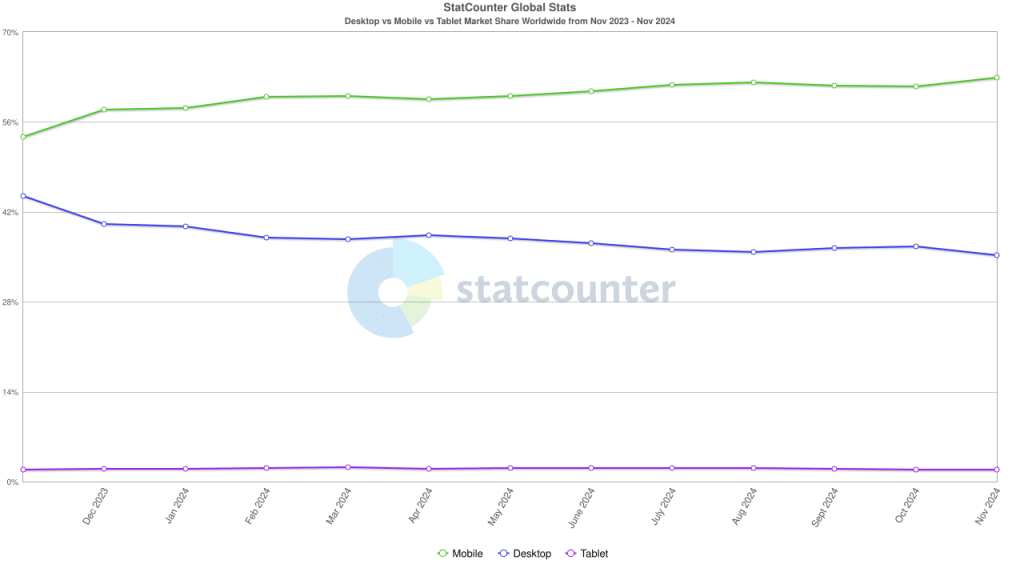

Device Market Share in 2024

No surprise here – worldwide device market share data from November 2023 to November 2024, shows mobile devices dominate internet usage at around 59%, while desktop accounts for approximately 39%. Tablet usage remains consistently low at about 2% throughout the period.

The data clearly indicates that mobile is the primary way users access the internet globally, with desktop as the secondary device and tablets having a minimal impact on overall internet consumption patterns.

SIDEBAR! Interesting key demographics for Tablet users:

- Gender: Nearly equal distribution with 50.8% female and 49.2% male users.

- Age: The largest group of tablet users falls between 25-34 years old, making up 25% of users.

- Income: A significant portion of tablet users, nearly 3 in 5, reside in households with an income of $75,000 or greater.

Social Media Stats Worldwide 2024

Based on the Backlinko article Social Media Usage & Growth Statistics Facebook remains the leading social network globally with over 3 billion active users. Four platforms have surpassed the 2 billion user mark: Facebook, YouTube, WhatsApp, and Instagram and seven platforms have over 1 billion active users. The list includes a mix of Western and Chinese platforms, reflecting the global nature of social media usage.

This ranking demonstrates the dominance of established platforms like Facebook and YouTube, while also showcasing the rapid rise of newer platforms like TikTok. It’s worth noting that user numbers are constantly changing, and these figures represent a snapshot of the social media landscape in 2024.

Top 15 Most Popular Social Media Platforms Worldwide

- Facebook: 3,065 million active users

- YouTube: 2,504 million active users

- WhatsApp: 2,000 million active users

- Instagram: 2,000 million active users

- TikTok: 1,582 million active users

- WeChat: 1,343 million active users

- Facebook Messenger: 1,010 million active users

- Telegram: 900 million active users

- Snapchat: 800 million active users

- Douyin: 755 million active users

- Kuaishou: 700 million active users

- X (Twitter): 611 million active users

- QQ: 598 million active users

- LinkedIn: 554 million active users

- Pinterest: 498 million active users

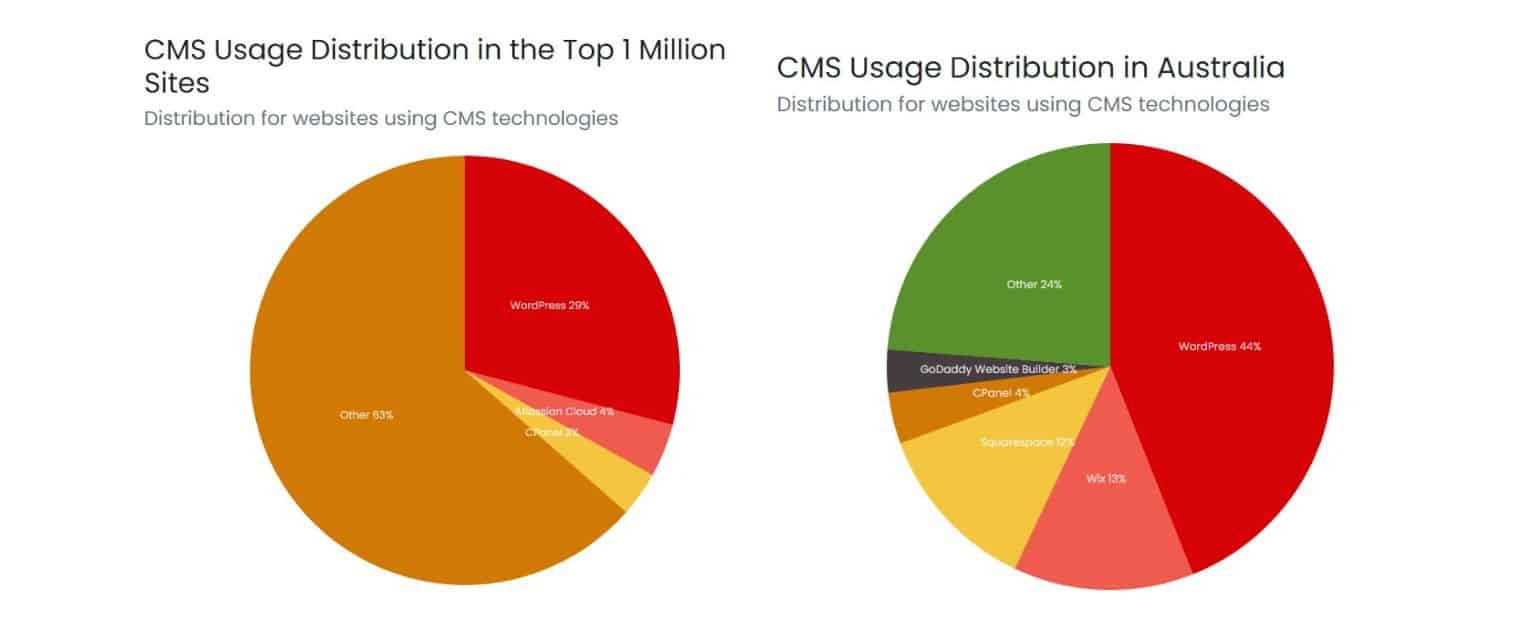

CMS Usage Distribution 2024

The Content Management System (CMS) usage distribution data for the top 1 million sites worldwide and in Australia highlights WordPress’s dominance, accounting for 29% and 44% of the market share, respectively. However, the Australian market exhibits more diversity, with Squarespace and Wix holding larger shares at 12% and 13%, compared to their global shares of only 4% and 2%.

This suggests that while WordPress leads in both markets, Australian websites are more likely to use alternative CMS platforms.

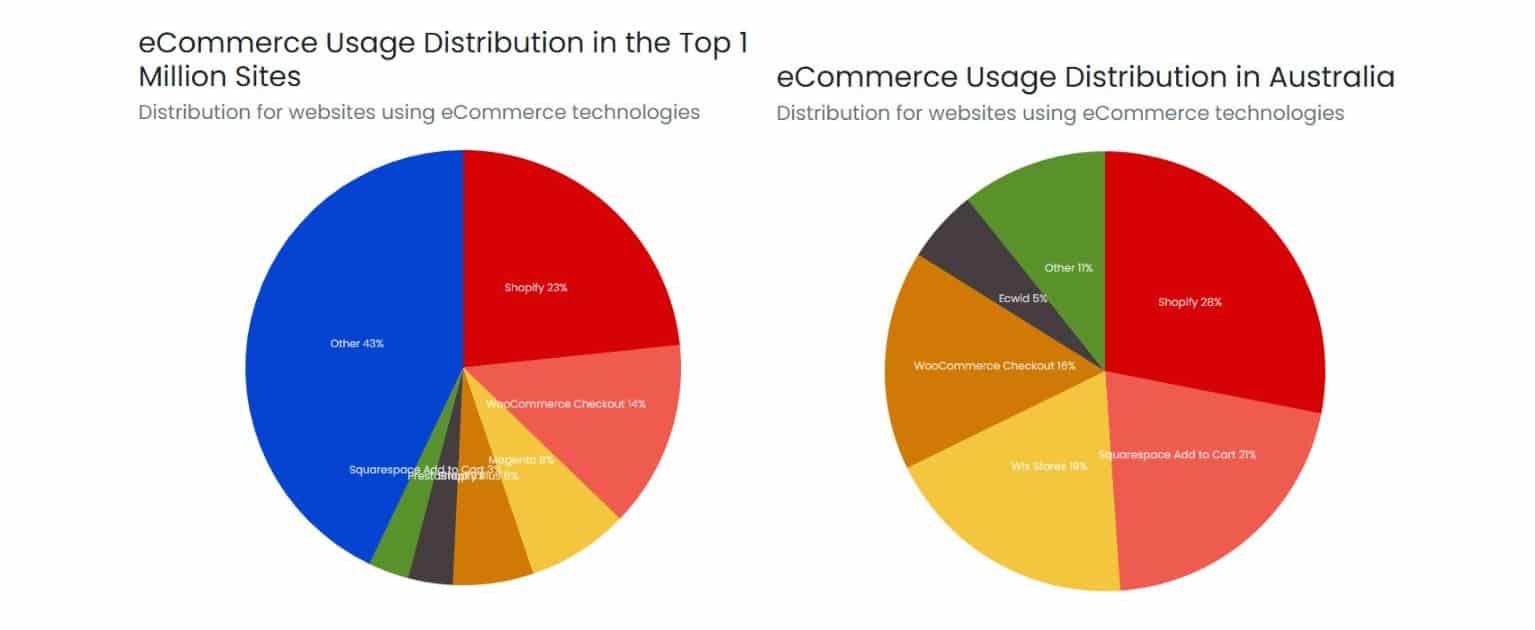

eCommerce Platform Usage 2024

The eCommerce platform usage data reveals that Shopify holds the largest market share both globally (23%) and in Australia (28%), highlighting its dominant position in the eCommerce industry. However, there are notable differences between the worldwide and Australian markets. WooCommerce and Squarespace “Add To Cart” have a significantly stronger presence in Australia at 18% and 21% respectively, compared to their global shares of 14% and 4%.

This suggests that Australian eCommerce websites are more likely to choose these platforms as alternatives to Shopify, indicating potential regional preferences or market-specific factors influencing platform adoption.

TL;DR

Chrome dominates the browser market across desktop, mobile, and tablet devices, both worldwide and in Australia

Mobile phones emerge as the primary device for internet access globally, while desktops remain significant

WordPress leads the CMS market, but Australia shows more diversity

In the eCommerce platform space, Shopify holds the top position globally, with WooCommerce and Squarespace having a stronger presence in the Australian market compared to worldwide averages

Transforming Data into Digital Growth

At Clickify, data is our oxygen. Numbers allow us to make informed choices about how to grow your business online. By understanding these 2024 internet usage trends, we can craft targeted strategies that put your brand in front of the right people, on the right platforms, at the right times.

Whether you’re looking to boost your search engine marketing, grow your social following, or optimise your eCommerce conversions, we’re here to help you harness the power of data for real, measurable results.

Our business is getting your business found online.